Director Nominees & Directors | | Business Experience (1) | | | | | | | | | | Justin G. Knight | President and

| Director Since: 2015 | | | | Chief Executive Officer Age: 45

Director Since: 2015

Committees: Executive

| | Age: 48 | | | | | | Committees: • Executive | | | | | | | | | | | | | | | | | | | Business Experience (1) | | | | | | | | | | Mr. Knight has served as Chief Executive Officer of the Company since May 2014 and served as President of the Company sincefrom its inception and Chief Executive Officer since May 2014.through March 2020. Mr. Knight also served as President of each of the former Apple REIT Companies, except Apple Suites, until they were sold to a third party or merged with the Company, as described in Note 1 below. Mr. Knight joined the Apple REIT Companies in 2000 and held various senior management positions prior to his appointment as President. Mr. Knight currently serves on the Board of Trustees for Southern Virginia University in Buena Vista, Virginia, founded by the Company’s Executive Chairman, Glade M. Knight. Mr. Knight serves on the Marriott Owners Advisory Council, onas President of the Residence Inn Association Board, and as Secretary, Treasurer and member of the Executive CommitteeChair of the Board of Directors of the American Hotel & Lodging Association and Lodging Association.a member of its Executive Committee. Mr. Knight is also a member of the National Advisory Council of the Marriott School at Brigham Young University, Provo, Utah. Mr. Knight holds a Master of Business Administration degree with an emphasis in Corporate Strategy and Finance from the Marriott School at Brigham Young University. He also holds a Bachelor of Arts degree, Cum Laude, in Political Science from Brigham Young University. The Board of Directors believes his extensive executive experience and REIT industry, hotel industry, strategic planning, investment, finance and management experience provide him with the skills and qualifications to serve as a director. Justin G. Knight is the son of Glade M. Knight, the Company’s Executive Chairman, and the brother of Nelson G. Knight, the Company’s Executive Vice President, Real Estate and Chief Investment Officer.Investments. | | | | |

| | | | | | Bruce H. Matson

Age: 61

Director Since: 2008

Committees: Executive,Nominating and Corporate Governance (Chair)

| | Mr. Matson serves as Director, Chief Administrative Officer and General Counsel for Randolph Square IP, LLC and its affiliate RSIP Management, LLC, businesses focused on the use of proprietary analytics to help organizations understand and leverage the value of their intellectual property, including the use of patent litigation finance. Mr. Matson is also a Partner in the law firm of LeClairRyan, a Professional Corporation, in Richmond, Virginia. Mr. Matson joined LeClairRyan in 1994 and has practiced law since 1983. Mr. Matson was a member of the Company’s Audit and Compensation Committees until March 1, 2014 and served as the Chair of the Company’s Compensation Committee during this period. He also previously served as a director of Apple Two, Apple Five, Apple Six and Apple Seven until they were sold to a third party or merged with the Company, as described in Note 1 below. Mr. Matson graduated from the College of William and Mary, Marshall-Wythe School of Law and earned his bachelor’s degree from the College of William and Mary. The Board of Directors believes his extensive legal, commercial finance and business restructuring experience provides him with the skills and qualifications to serve as a director.

|

Director Nominees & Directors | | Business Experience (1) | | | | Blythe J. McGarvie | Age: 62

| Director Since: 2018 | | | Age: 65 | | | Committees:Audit, • Nominating and Corporate Governance (Chair) | | | | | | | Business Experience | | | | Ms. McGarvie was a member of the faculty of Harvard Business School, teaching in the accounting and management department from July 2012 to June 2014. Ms. McGarvie served as Chief Executive Officer and Founder of Leadership for International Finance, LLC, an advisory firm offering consulting services and providing leadership seminars, from 2003 to 2012, where she offered strategic reviews and leadership seminars for improved decision-making for corporate and academic groups. From 1999 to 2002, Ms. McGarvie was the Executive Vice President and Chief Financial Officer of BIC Group, a publicly traded consumer goods company with operations in 36 countries. Prior to that, Ms. McGarvie served as Senior Vice President and Chief Financial Officer of Hannaford Bros. Co., a Fortune 500 retailer. Ms. McGarvie currently serves on the boards of directors of LKQ Corporation (“LKQ”), Sonoco Products Company (“Sonoco”) and Wawa, Inc., and previously served on the boards of directors of Accenture plc, Viacom Inc., Pepsi Bottling Group, Inc., The Travelers Companies, Inc. and Lafarge North America. She serves as chair of the LKQ Audit Committee and a member of its Governance/Nominating Committee and onas chair of the Financial Policy Committee and a member of the Audit Committee and Financial Policy CommitteesEmployee and Public Responsibility Committee for Sonoco. Ms. McGarvie is a Certified Public Accountant and holds a Bachelor of Arts degree in Economics from Northwestern University, Evanston, Illinois, and a Master of Business Administration from Northwestern University’s J.L. Kellogg Graduate School of Management. Ms. McGarvie also holds an Executive Masters Professional Director Certification from the American College of Corporate Directors. The Board of Directors believes her extensive experience serving on a wide range of boards, as well as her strong finance and accounting background and entrepreneurial success provide her with the skills and qualifications to serve as a director. | | | | |

7

Table of contents | | | | | | | | | | Daryl A. Nickel | | Director Since: 2015 | | | | | Age: 77 | | | | | Committees: • Compensation • Executive • Nominating and Corporate Governance | | | | | | | | | | | | | | | Business Experience | | | | | | | | Mr. Nickel completed a 22-year career at Marriott International, Inc., a multinational hospitality company, in 2009. He served as a corporate officer of Marriott International from 1998 until his retirement and as Executive Vice President, Lodging Development, Select Service and Extended Stay Brands from 2001 until his retirement. After retiring from Marriott, Mr. Nickel continued to serve on the advisory board of the Hunter Hotel Investment Conference until 2021 and worked as a consultant to several hotel companies, including Apple Fund Management, LLC (currently a Company subsidiary) from 2009 to 2010 and White Peterman Properties, Inc., a hotel development company, from 2011 to 2021. Before joining Marriott, Mr. Nickel was Senior Vice President in charge of franchise development at the Residence Inn Company, prior to its acquisition by Marriott. While in private practice, Mr. Nickel was managing partner of a D.C. law firm and his practice included representation of several hotel companies. Mr. Nickel graduated from Georgetown Law School and earned his Bachelor of Arts degree from Washburn University. Between college and law school, Mr. Nickel served in the U.S. Navy. The Board of Directors believes his executive management positions in the lodging industry and his hotel development and consulting experience provide him with the skills and qualifications to serve as a director. | | | |

| | | | | | | | | | | | | | | L. Hugh Redd | Age: 61

| Director Since: 2015 | | | | | | Age: 64 | | | | | | Committees: Committees:

•Audit (Chair), • Compensation | | | | | | | | | | | | | | | | | | | Business Experience | | | | | | | | | | Mr. Redd was the Senior Vice President and Chief Financial Officer of General Dynamics Corporation, an aerospace and defense company, until December 2013. He had worked for General Dynamics Corporation since 1986, serving as a Senior Financial Analyst and also as Vice President and Controller of General Dynamics Land Systems in Sterling Heights, Michigan. He received a Bachelor of Science degree in Accounting from Brigham Young University and a Master in Professional Accounting degree from the University of Texas. He is also a Certified Public Accountant. Mr. Redd currently serves onas Chairman of the Board of Trustees for Southern Virginia University in Buena Vista, Virginia. The Board of Directors believes his extensive financial and accounting experience, as well as his public company management experience, in public companies, provide him with the skills and qualifications to serve as a director. | | | | |

Director Nominees & Directors | | Business Experience (1) | | Directors of the Company whose terms expire at the 2020 annual meeting of shareholders:

| | | | | | Glenn W. BuntingHoward E. Woolley

| Age: 74

| Director Since: 2014 2021 | Committees: Audit, Compensation (Chair), Executive

| | Age: 64 | | | Committees: • Nominating and Corporate Governance | | | | | | | Business Experience | | | | Mr. BuntingWoolley has served as President of GB CorporationHoward Woolley Group, LLC, a government relations, public policy and regulatory risk advisory firm serving large technology and wireless industry corporations, since January 2011. From 1985 until 2010,2015. His firm has also provided diversity, equity, and inclusion advice to clients. Prior to founding Howard Woolley Group, LLC, Mr. BuntingWoolley served as Senior Vice President Wireless Policy and Chief Executive OfficerStrategic Alliances for Verizon Communications Inc. (“Verizon”). During his tenure at Verizon, Mr. Woolley led the federal and state government relations for Verizon Wireless which contributed to the company’s growth and expansion. He advised all CEOs of American KB Properties,Verizon Wireless on public policy from the company’s founding in 2000 until his retirement in 2013. From 1981 until 1993, Mr. Woolley served in various congressional affairs and regulatory public policy positions ultimately rising to the position of Vice President, Regulatory Affairs, with the National Association of Broadcasters. Mr. Woolley currently serves as the Lead Director on the Board of Directors for Somos, Inc., which developeda telecommunications registry management and managed shopping centers.data solutions company, and serves on the Compensation Committee and Nominating and Governance Committee of such board. Mr. Bunting was a directorWoolley also serves on the Allianz Life Insurance Company of Cornerstone Realty Income Trust, Inc.,North America Board of which Glade M. Knight was Chairman and Chief Executive Officer, from 1993 until its merger with Colonial Properties Trust in 2005. He also served asDirectors where he is a member of the Audit Committee and the Nomination, Evaluation and Compensation Committee. Mr. Woolley serves on the Board of DirectorsTrustees for Johns Hopkins University and the Board of Landmark Apartment TrustTrustees for Johns Hopkins Medicine and the Executive Committee of America until 2016 when it merged withsuch board, and into an affiliateco-chairs the Johns Hopkins University and Medicine External Affairs and Community Engagement Committee. Mr. Woolley is on the Board of Starwood Capital Group.Trustees for Syracuse University and serves on the Audit and Risk Committee and Academic Affairs Committee for such board. Beginning in 2010, Mr. BuntingWoolley served as a directoron the boards of Apple Two, Apple Five, Apple Seven and Apple Eight untilleading civil rights organizations including the companies were sold to a third party or merged with the Company, as described in Note 1 below.National Urban League. Mr. Bunting receivedWoolley holds a Bachelor of Business AdministrationScience degree from Campbellthe S.I. Newhouse School of Public Communications at Syracuse University and a Master of Administrative Sciences degree in business from Johns Hopkins University. Mr. Woolley is a National Association of Corporate Directors Governance Fellow. The Board of Directors believes his extensive managementleadership and REITgovernance experience, as well as his experience in public policy, regulatory and strong background in commercial real estate and financegovernment affairs, provide him with the skills and qualifications to serve as a director. | | | | Glade M. Knight

Executive Chairman

Age: 75

Director Since: 2007

Committees: Executive (Chair)

| | Mr. Knight is the founder of the Company and has served as Executive Chairman since May 2014, and previously served as Chairman and Chief Executive Officer of the Company since its inception. Mr. Knight was also the founder of each of the former Apple REIT Companies and served as their Chairman and Chief Executive Officer from their inception until the companies were sold to a third party or merged with the Company, as described in Note 1 below. In addition, Mr. Knight served as Chairman and Chief Executive Officer of Cornerstone Realty Income Trust, Inc., a REIT, from 1993 until it merged with Colonial Properties Trust, a REIT, in 2005. Following the merger in 2005 until April 2011, Mr. Knight served as a trustee of Colonial Properties Trust. Cornerstone Realty Income Trust, Inc. owned and operated apartment communities in Virginia, North Carolina, South Carolina, Georgia and Texas. Mr. Knight is a partner and Chief Executive Officer of Energy 11 GP, LLC, the general partner of Energy 11, L.P., and Energy Resources 12 GP, LLC, the general partner of Energy Resources 12, L.P., partnerships focused on investments in the oil and gas industry. Mr. Knight is the founding Chairman of Southern Virginia University in Buena Vista, Virginia. He also is a member of the Advisory Board to the Graduate School of Real Estate and Urban Land Development at Virginia Commonwealth University. Additionally, he serves on the National Advisory Council for Brigham Young University and is a founding member of the University’s Entrepreneurial Department of the Graduate School of Business Management. The Board of Directors believes his extensive REIT executive experience and extensive background in real estate, corporate finance and strategic planning, as well as his entrepreneurial background, provide him with the skills and qualifications to serve as a director. On February 12, 2014, Mr. Knight, Apple Seven, Apple Eight, Apple Nine and their related advisory companies entered into settlement

|

Director Nominees & Directors | | Business Experience (1) | | | | | | agreements with the SEC. Along with Apple Seven, Apple Eight, Apple Nine and their advisory companies, and without admitting or denying the SEC’s allegations, Mr. Knight consented to the entry of an administrative order, under which Mr. Knight and the noted companies each agreed to cease and desist from committing or causing any violations of Sections 13(a), 13(b)(2)(A), 13(b)(2)(B), 14(a), and 16(a) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) and Rules 12b-20, 13a-1, 13a-13, 13a-14, 14a-9, and 16a-3 thereunder.

Glade M. Knight is the father of Justin G. Knight, the Company’s President and Chief Executive Officer, and Nelson G. Knight, the Company’s Executive Vice President and Chief Investment Officer.

| | | | Daryl A. Nickel

Age: 74

Director Since: 2015

Committees:Compensation, Executive, Nominating and Corporate Governance

| | Mr. Nickel completed a 22-year career at Marriott International, Inc., an international hospitality company, in 2009. He served as a corporate officer of Marriott International from 1998 until his retirement and as Executive Vice President, Lodging Development, Select Service and Extended Stay Brands from 2001. Since 2011, Mr. Nickel has served as a consultant to White Peterman Properties, Inc., a hotel development company. From 2011 until July 2014, Mr. Nickel served as a consultant to Whiteco Pool Solutions, a saline pool systems company. From 2009 to 2010, Mr. Nickel served as a consultant to Apple Fund Management, Inc., currently a subsidiary of the Company. Mr. Nickel graduated from Georgetown Law School and earned his Bachelor of Arts degree from Washburn University. Between college and law school, Mr. Nickel served in the U.S. Navy. The Board of Directors believes his extensive consulting experience with diverse organizations and executive management positions in the lodging industry provide him with the skills and qualifications to serve as a director.

|

(1) | Below are the “former Apple“Apple REIT Companies” that were sold to a third party or merged with the Company. All of the Apple REIT Companies, founded by Glade M. Knight, were REITs with ownership of primarily rooms-focused hotels. |

| | | | | Company | | FormationDate | | Sale/Merger Description | Apple Suites, Inc. (“Apple Suites”) | | 1999 | | Merged with Apple Hospitality Two, Inc. in January 2003 | Apple Hospitality Two, Inc. (“Apple Two”) | | 2001 | | Sold to an affiliate of ING Clarion in May 2007 | Apple Hospitality Five, Inc. (“Apple Five”) | | 2002 | | Sold to Inland American Real Estate Trust, Inc. in October 2007 | Apple REIT Six, Inc. (“Apple Six”) | | 2004 | | Sold to an affiliate of Blackstone Real Estate Partners VII in May 2013 | Apple REIT Seven, Inc. (“Apple Seven”) | | 2005 | | Merged with the Company in March 2014 | Apple REIT Eight, Inc. (“Apple Eight”) | | 2007 | | Merged with the Company in March 2014 | Apple REIT Nine, Inc. (“Apple Nine”) | | 2007 | | Original name of the Company. Name changed to Apple Hospitality REIT, Inc. in March 2014 | Apple REIT Ten, Inc. (“Apple Ten”) | | 2010 | | Merged with the Company in September 2016 |

Proposal 2.2. Advisory Vote On Executive Compensation Paid by the Company In accordance with Section 14A of the Exchange Act, the Company is providing its shareholders with the opportunity to approve, on a non-binding, advisory basis, the compensation paid to the Company’s named executive officers as disclosed in this proxy statement. The Board of Directors has adopted a policy, which shareholders approved by a non-binding advisory vote, of providing for an annual “say-on-pay” advisory vote. The Company encourages shareholders to read the disclosure under “Compensation Discussion and Analysis” for more information concerning the Company’s compensation philosophy, programs and practices, the compensation and governance-related actions taken in fiscal 2018year 2021 and the compensation paid to the named executive officers. Accordingly, the Company is asking you to approve the adoption of the following resolution: RESOLVED: That the shareholders of the Company approve, on a non-binding, advisory basis, the compensation paid to the Company’s named executive officers, as disclosed pursuant to Item 402 of Regulation S-K, including the Compensation Discussion and Analysis, compensation tables and narrative discussion in the proxy statement. The affirmative vote of a majority of the votes cast will be necessary to approve this proposal. Abstentions and broker non-votes will have no effect on the outcome of this proposal. The shareholder vote on this proposal is advisory and non-binding and serves only as a recommendation to the Board of Directors. Although the vote is non-binding, the Compensation Committee and the Board of Directors value the opinions of shareholders and will consider the outcome of the vote when making future compensation decisions. THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE ABOVE PROPOSAL.

10

Table of contents Proposal 3.3. Ratification of the Appointment of Ernst & Young LLP as the Company’s Independent Registered Public Accounting Firm The firm of Ernst & Young LLP served as the independent registered public accounting firm for the Company in 2018.2021. A representative of Ernst & Young LLP is expected to be present at the Annual Meeting. The representative will have an opportunity to make a statement if he or she so desires and will be available to answer appropriate questions from shareholders. The Board of Directors has approved the retention of Ernst & Young LLP as the Company’s independent registered public accounting firm for 2019,2022, based on the recommendation of the Audit Committee. Independent accounting fees for the last two fiscal years are shown in the table below: Year | | Audit Fees | | | Audit-Related Fees | | | Tax Fees | | | All Other Fees | | 2018 | | $ | 972,500 | | | | — | | | $ | 420,000 | | | | — | | 2017 | | $ | 975,000 | | | | — | | | | — | | | | — | |

Year | | Audit Fees | | Audit-Related Fees | | Tax Fees | | All Other Fees | 2021 | | | $ | 946,900 | | | | | | — | | | | | $ | 477,150 | | | | | | — | | | 2020 | | | $ | 894,300 | | | | | | — | | | | | $ | 380,000 | | | | | | — | | |

All services rendered by Ernst & Young LLP are permissible under applicable laws and regulations, and the annual audit of the Company was pre-approved by the Audit Committee, as required by applicable law. The nature of each of the services categorized in the preceding table is described below: Audit Fees. These are fees for professional services rendered for the audit of the Company’s annual financial statements included in the Company’s Annual Report on Form 10-K, reviews of the financial statements included in the Company’s Quarterly Reports on Form 10-Q, or services normally provided by the independent auditor in connection with statutory or regulatory filings or engagements, and other accounting and financial reporting work necessary to comply with the standards of the Public Company Accounting Oversight Board (“PCAOB”) and fees for services that only the Company’s independent auditor can reasonably provide. Audit-Related Fees. These are fees for assurance and related services that are reasonably related to the performance of the audit or review of the Company’s financial statements. Such services include accounting consultations, internal control reviews, audits in connection with acquisitions, attest services related to financial reporting that are not required by statute or regulation and required agreed-upon procedure engagements. Tax Fees. Such services include tax compliance, tax advice and tax planning. The Company engaged Ernst & Young LLP to perform tax compliance and advisory services in December 2017. All Other Fees. These are fees for other permissible work that does not meet the above category descriptions. Such services include information technology and technical assistance provided to the Company. Generally, this category would include permitted corporate finance assistance, advisory services and licenses to technical accounting research software. These accounting services are actively monitored (as to both spending level and work content) by the Audit Committee to maintain the appropriate objectivity and independence in the core area of accounting work performed by Ernst & Young LLP, which is the audit of the Company’s consolidated financial statements. Pre-Approval Policy for Audit and Non-Audit Services. In accordance with the Sarbanes-Oxley Act of 2002, all audit and non-audit services provided to the Company by its independent auditors must be pre-approved by the Audit Committee. As authorized by that act, the Audit Committee has delegated to the Chair of the Audit Committee the authority to pre-approve up to $25,000 in audit and non-audit services. This authority may be exercised when the Audit Committee is not in session. Any decisions by the Chair of the Audit Committee under this delegated authority will be reported at the next meeting of the Audit Committee. All services reported in the preceding fee table for fiscal years 20172020 and 20182021 were pre-approved by the full Audit Committee, as required by then applicable law. The Company is asking you to vote on the adoption of the following resolution: RESOLVED: That the shareholders of the Company ratify the appointment of Ernst & Young LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2019. 2022. The affirmative vote of a majority of the votes cast will be necessary to approve this proposal. Abstentions will have no effect on the outcome of this proposal. The shareholder vote on this proposal is advisory and non-binding and serves only as a recommendation to the Board of Directors. If the shareholders do not ratify the appointment of Ernst & Young LLP by the affirmative vote of a majority of the votes cast at the meeting, the Audit Committee will reconsider whether or not to retain Ernst & Young LLP. THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE ABOVE PROPOSAL. 11

Table of contents Corporate Responsibility Overview The Company has always worked to uphold high environmental, social and governance standards. Alignment with the best interests of the Company’s shareholders is at the forefront of Apple Hospitality’s values. Apple Hospitality is committed to maintaining strong governance practices that align with the best interests of its shareholders, minimizing the environmental impact of the Company and its hotels, and making a positive impact throughout the Company, the hospitality industry, local communities and the many communities served by the Company’s hotels. Together with brand affiliates, hotel management teams and industry colleagues, Apple Hospitality is focused on advancing sustainability initiatives that effectively balance environmental stewardship with the Company’s business goals, improving communities through thoughtful outreach programs, and promoting diversity, equity and inclusion. The Company remains focused on enhancing its Corporate Responsibility disclosures to provide stakeholders with a better understanding of the Company’s policies, programs, procedures and initiatives related to environmental stewardship, social responsibility and corporate governance. In 2020, the Company formally adopted the following policies: a Health, Safety and Well-Being Policy; a Human Rights Policy; and a Vendor Code of Conduct. All of the above policies are available within the Corporate Responsibility section of the Company's website at https://applehospitalityreit.com/corporate-responsibility/. Apple Hospitality’s policies are supported by the Board of Directors, and the Nominating and Corporate Governance Committee reviews the Company’s policies, programs and practices related to corporate responsibility and sustainability, including environmental, social, human capital and other matters. The Company’s senior management team is responsible for providing oversight over policy enforcement and updating the Company’s Board of Directors on implementation efforts. The Company commits to reporting publicly to its stakeholders on its progress and to considering stakeholder feedback to support the ongoing evolution of programs and strategies in support of the Company’s policies. The Company’s Environmental, Social and Governance (“ESG”) Advisory Committee is comprised of key Company leaders and is responsible for overseeing the Company’s ESG policies, initiatives and disclosures. The Company’s Chief Financial Officer serves as the executive sponsor for the ESG Advisory Committee. The Company is working towards the publication of a Corporate Responsibility Report that it expects to publish later in 2022 that will convey its corporate responsibility strategy and priorities in detail, including the Company’s responsible investments, sustainability initiatives, environmental stewardship, social impact initiatives, community outreach and governance practices, including various metrics. To further advance the Company’s environmental, social and governance initiatives and standards, the Company is actively working towards the establishment of environmental stewardship and social responsibility targets.

12

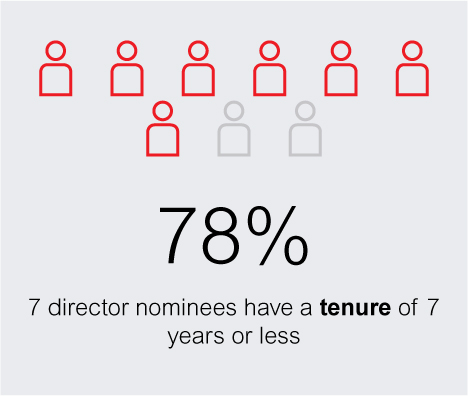

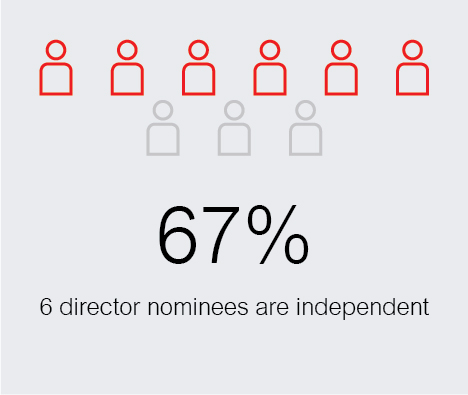

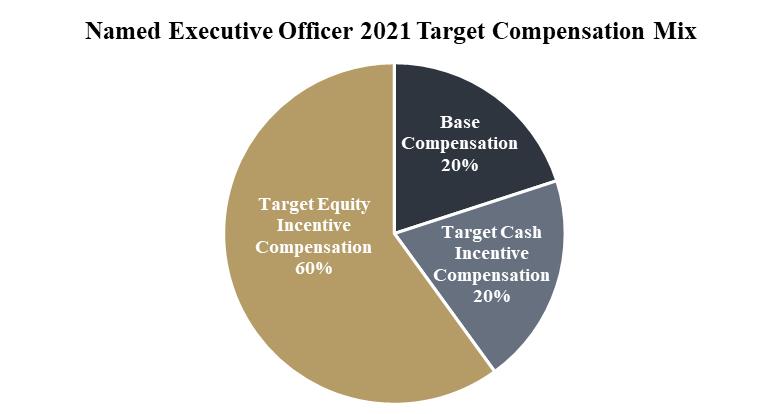

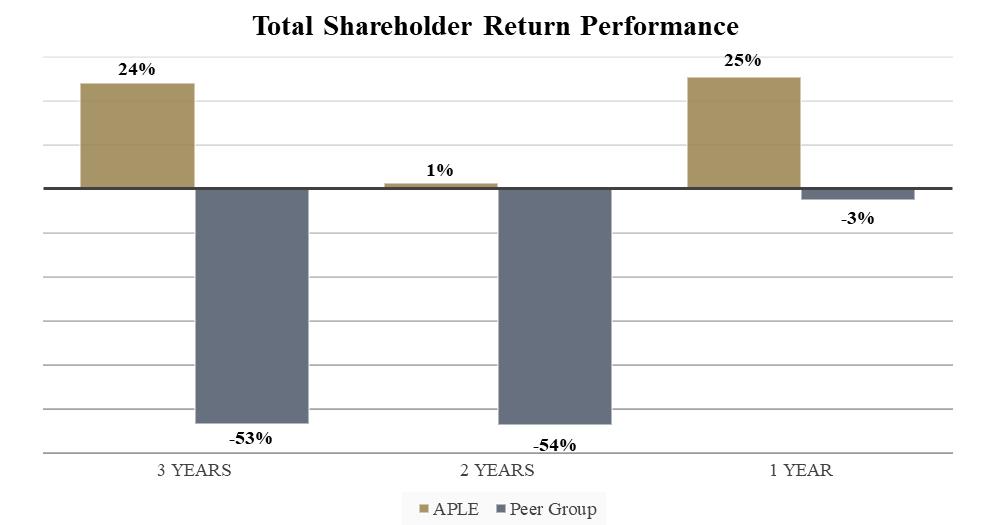

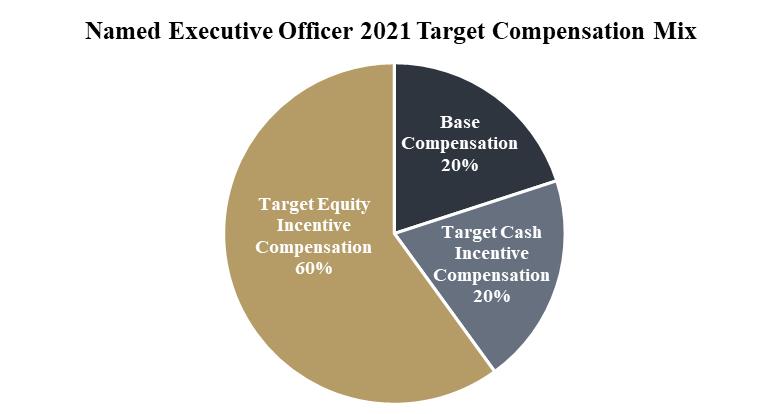

Table of contents Corporate Governance Practices Below are some highlights of the Company’s corporate governance practices. | | Practice | Description | | | Annual director elections with majority vote requirements | An incumbent director not receiving the majority of the votes cast in an election must tender his or her resignation from the Board | | | Independent directors | All members of the Audit, Compensation, and Nominating and Corporate Governance Committees are independent directors who have access to management and employees | | | Board independence | • Six out of nine of the Company’s directors are independent • Executive Chairman of the Board and Chief Executive Officer are the only employee directors | | | Board diversity | Two out of nine directors are female and one is racially diverse | | | Lead independent director | Lead Independent Director is designated by independent directors, maintains expansive duties intended to optimize the Board’s effectiveness and independence, including serving as a liaison to facilitate communications between management and shareholders and the Board | | | Separation in leadership structure | Executive Chairman of the Board and Chief Executive Officer are separate individuals | | | Board self-evaluations | Nominating and Corporate Governance Committee oversees an annual self-evaluation of the Board and each committee | | | Succession planning | The Board actively monitors the Company’s succession planning and employee development and receives regular updates on employee engagement, retention and diversity | | | Director stock ownership | Directors are required to own securities of the Company with a value of at least 4 times their annual base cash retainer | | | Executive stock ownership | Executive officers are required to own securities of the Company with a value of at least 5 times (Chief Executive Officer) and 3 times (other executive officers) their annual base salary | | | Anti-hedging policy | The Company’s Insider Trading Policy prohibits directors and employees from engaging in any hedging of Company securities | | | Code of business conduct and ethics | The Company has a Code of Business Conduct and Ethics that serves as the foundation for how it conducts its business | | | Incentive-based compensation | 77% of 2021 target compensation for executive officers is incentive-based (50% based on shareholder return metrics and 50% based on operational performance metrics) | | | Elimination of certain takeover defenses | • The Company opted out of the Virginia Stock Corporation Act provisions requiring super majority vote for specified transactions with interested shareholders • The Company has elected, pursuant to a provision in its bylaws, to exempt any acquisition of its shares from the control share acquisition provisions of the Virginia Stock Corporation Act | | | Accountability to shareholders | • Annual advisory vote on executive compensation • No shareholder rights plan • Continual shareholder outreach, communication and engagement |

13

Table of contents Sustainability Initiatives The Company established a formal energy management program in 2018 and adopted a formal Environmental Policy in 2020 to ensure that energy efficiency, water conservation and waste management are a priority not only within the Company, but also with the Company’s third-party management companies and brands. As noted previously, the Company is working towards the publication of a Corporate Responsibility Report in 2022, including, as they relate to environmental matters, the Company’s responsible investments, sustainability initiatives and environmental stewardship. To further advance the Company’s sustainability initiatives and standards, the Company is working towards the establishment of reduction targets for its primary environmental impacts. Due to their efficient operating model and strong consumer preference, the Company is primarily invested in rooms-focused hotels. In addition to being more operationally efficient, rooms-focused hotels are more environmentally efficient than full-service hotels and resorts and use less electricity, water and natural gas on a per-square-foot basis. In addition to its overall strategy of investing in rooms-focused hotels, the Company is committed to identifying and incorporating sustainability opportunities into its investment and asset management strategies, with a focus on minimizing its environmental impact through reductions in energy and water consumption and improvements in waste management. The Company’s hotels are concentrated in the Marriott, Hilton and Hyatt brand families. In addition to the initiatives the Company implements at its hotels through its asset management strategies, the Company also works with its third-party management companies to leverage brand initiatives to further drive sustainability across its hotels. The Company seeks to invest in proven sustainability practices when renovating its hotels and in portfolio-wide capital projects that can enhance asset value while also improving environmental performance. For example, the Company has realized cost savings and reductions in its carbon footprint through the installation of LED lighting, energy management systems, smart irrigation systems and the use of energy and water conservation guidelines at the property level, with 100% of the Company’s portfolio enrolled in the U.S. Environmental Protection Agency’s ENERGY STAR® program. Additionally, as part of the Company’s acquisition due diligence, the Company performs sustainability assessments to identify areas of opportunity that will improve the property’s environmental performance, and when working with developers to construct new hotels, strives to implement environmentally efficient construction and building functionality. For example, in 2020, the Company acquired a newly constructed Hyatt House and Hyatt Place in Tempe, Arizona, that are LEED Certified®. In 2021, the Company acquired a Hampton Inn & Suites in Portland, Oregon that was constructed with a green roof system. Additional information related to the Company’s sustainability initiatives can be found on the Company’s website at https://applehospitalityreit.com/sustainability/. Information on or accessible through the Company’s website is not and should not be considered part of this proxy statement. Social Responsibility Apple Hospitality is dedicated to making a positive impact throughout the Company, local communities, the hospitality industry and the many communities served by the Company’s hotels. The safety, health and well-being of guests, hotel associates and employees has always been the Company’s top priority, and since the onset of the COVID-19 pandemic, the Company has worked diligently to implement enhanced safety and cleanliness protocols at all of its hotels and its corporate office. In 2020, Apple Hospitality formally adopted a Health, Safety and Well-Being Policy, a Human Rights Policy and a Vendor Code of Conduct to further drive positive social impact. Additional information related to the Company’s social responsibility initiatives can be found on the Company’s website at https://applehospitalityreit.com/social-responsibility/. Information on or accessible through the Company’s website is not and should not be considered part of this proxy statement. As noted above, the Company is working towards the publication of a Corporate Responsibility Report in 2022 that will convey its corporate responsibility strategy, priorities and metrics in detail, including, as they relate to social responsibility matters, the Company’s social impact initiatives and community outreach. The Company is actively working towards the establishment of targets that will further advance the Company’s social responsibility initiatives and standards. The Company is committed to strengthening its communities through charitable giving, encouraging employees to volunteer their time and talents, and participation in the many philanthropic programs important to its employees and leaders within its industry, including its brands, the American Hotel & Lodging Association and its third-party hotel management companies. In 2017, the Company formed Apple Gives, an employee-led charitable organization, to expand its impact and further advance the achievement of the Company’s corporate philanthropic goals. Apple Gives organizes company-wide community events with charitable organizations, deploys aid to markets and associates affected by natural disasters, and allocates funds and other resources to a variety of causes. Apple Gives strives to select organizations that are important to the Company’s employees, the Company’s third-party management 14

Table of contents companies, its hotels and numerous industry organizations. Since Apple Gives was formed, the Company has contributed to more than 100 non-profit organizations, including through company-matched donations, and employees have devoted more than 550 hours volunteering and fundraising for a variety of charitable organizations. The Company’s hotels and third-party management companies are engaged in targeted charitable programs that provide support to their respective communities, and hotel associates are encouraged to serve in ways that improve their localities. The Company’s third-party management colleagues donate to food drives, participate in charity walks and bike rides, assemble care packages, donate school supplies, provide disaster relief, and pursue numerous other altruistic initiatives. 550+ Hours Volunteered by the Company’s Employees | 100+ Non-Profit Organizations Helped by the Company |

Human Capital The Company believes that each of its team members plays a vital role in the success of the organization. Management aims to provide an inspiring, equitable and inclusive work environment where employees feel valued, empowered and encouraged to make positive differences within the Company and throughout their communities, with a belief that the most successful management provides clear leadership while empowering the team to make timely and responsible decisions and to take actions necessary to achieve exceptional operating results. The Company is committed to diversity, equity and inclusion and does not tolerate discrimination or harassment in the workplace. The Company’s executive team, comprising eight individuals, is 50% female.

The Company has implemented various initiatives to ensure the Company remains inclusive, equitable and supportive for all, including: a formal online training program that all employees of the Company are required to complete annually focused on the prevention of discrimination and harassment in the workplace, including unconscious bias; the Company’s CEO, Justin G. Knight, took the CEO Action for Diversity & Inclusion™ pledge, which is the largest CEO-driven business commitment to advance diversity and inclusion in the workplace; and the recruitment of a diverse pool of candidates for all job vacancies. The Company offers competitive compensation and benefits, a flexible leave policy, fully paid parental leave, an education reimbursement program, and a culture that encourages balance of work and personal life. The Company provides its employees with two days paid leave each year for volunteer work and donation matching to support non-profit organizations. The Company emphasizes an open-door policy for communications and conducts annual employee satisfaction surveys, which provide the opportunity for continuous improvement. The Company is committed to working safely and maintaining a safe workplace in compliance with cleanliness guidelines set forth by the Centers for Disease Control and Prevention, and in compliance with applicable Occupational Safety and Health Act standards. All employees involved in the day-to-day operation of the Company’s hotels are employed by third-party management companies engaged pursuant to the hotel management agreements. Apple Hospitality is committed to the health, safety, security and well-being of hotel associates and guests and is proud to support the initiatives of the 15

Table of contents American Hotel & Lodging Association (AHLA), including: the 5-Star Promise; Safe Stay initiative; No Room for Trafficking program; and career development opportunities. The Company’s CEO serves as the chair of the AHLA 2022 Board of Directors. Corporate Governance, Risk Oversight and Procedures for Shareholder Communications Board of Directors. The Company’s Board of Directors has determined that all of the Company’s directors (and nominees for director), except Mrs. Kristian M. Gathright, Mr. Glade M. Knight and Mr. Justin G. Knight, are “independent” within the meaning of the rules of the New York Stock Exchange (“NYSE”). In making this determination, the Board considered all relationships between the applicable director and the Company, including commercial, industrial, banking, consulting, legal, accounting, charitable and familial relationships. March 31, 2020. The Board has adopted a categorical standard that a director is not independent (a) if he or she receives any personal financial benefit from, on account of or in connection with a relationship between the Company and the director (excluding directors’ fees and equity-based awards); (b) if he or she is a partner, officer, employee or managing member of an entity that has a business or professional relationship with, and that receives compensation from, the Company; or (c) if he or she is a non-managing member or shareholder of such an entity and owns 10% or more of the membership interests or common stock of that entity. The Board may determine that a director with a business or other relationship that does not fit within the categorical standard described in the immediately preceding sentence is nonetheless independent, but in that event, the Board is required to disclose the basis for its determination in the Company’s then current annual proxy statement. In order to optimize the effectiveness and independence of the Board, the independent directors have designated an independent, non-employee director to serve as the Company’s Lead Independent Director, which currently is held by Jon Fosheim. See “Committees of the Board and Board Leadership.” Code of Ethics. The Board has adopted a Code of Business Conduct and Ethics for the Company’s officers, directors and employees, which is available at the Company’s website, www.applehospitalityreit.com. The purpose of the Code of Business Conduct and Ethics is to promote (a) honest and ethical conduct, including the ethical handling of actual or apparent conflicts of interest; (b) full, fair, accurate, timely and understandable disclosure in periodic reports required to be filed by the Company; and (c) compliance with all applicable rules and regulations that apply to the Company and its officers, directors and employees. Any waiver of the Code of Business Conduct and Ethics for the Company’s executive officers or Board may be made only by the Board or one of the Board’s committees. The Company anticipates that any waivers of the Code of Business Conduct and Ethics will be posted on the Company’s website. Corporate Governance Guidelines Guidelines. The Board has adopted Corporate Governance Guidelines that set forth the guidelines and principles for the conduct of the Board of Directors, which is available at the Company’s website, www.applehospitalityreit.com. The Corporate Governance Guidelines reflect the Board of Directors’ commitment to monitoring the effectiveness of decision-making at the Board and management level and ensuring adherence to good corporate governance principles, all with a goal of enhancing shareholder value over the long term. Risk OversightOversight.. The Board believes that risk oversight is a key function of a Board of Directors. It administers its oversight responsibilities through its Audit Committee, Nominating and Corporate Governance Committee and Compensation Committee. All members of each of these committees are independent directors. The entire Board is kept abreast of and involved in the Company’s risk oversight process. It is through the approval of officers and compensation plans, as well as management updates on property performance, industry performance, financing strategy, acquisitions and dispositions strategy and capital improvements, that the Board has input to manage the Company’s various risks. Additionally, through the Audit Committee, the Board reviews management’s and independent auditors’ reports on the Company’s internal controls and any associated potential risks of fraudulent activities.activities as well as risks related to cyber security. Through the Nominating and Corporate Governance Committee, the Board reviews the Company’s Corporate Governance Guidelines and related risks.risks, as well as the Company’s policies, programs and practices related to corporate responsibility and sustainability, including environmental and related risks, social, human capital and other matters. Through the Compensation Committee, the Board oversees risk related to compensation practices with the objective of balancing risk/rewards to overall business strategy.strategy, including the Company’s corporate responsibility initiatives. Risk oversight is also one of the factors considered by the Board in establishing its leadership structure. The Company has separated the roles of Executive Chairman and Chief Executive Officer to create a leadership structure that the Board believes strikes the appropriate balance between the authority of those who oversee the Company and 16

Table of contents those who manage it on a day-to-day basis and also has a Lead Independent Director to optimize the effectiveness and independence of the Board. Shareholder CommunicationsCommunications.. The Company and the Board value the views and opinions of the Company’s shareholders and believe strong corporate governance practices demand consistent outreach, effective communication and regular engagement with shareholders. Regular shareholder engagement better positions the Company to: understand which issues are most important to its shareholders and provide relevant information; provide transparency related to its business, operations, strategies, governance and compensation; recognize expectations for future performance; identify emerging issues that may affect its business, operations, strategies, governance or compensation; and obtain valuable feedback of its business and the lodging industry in general. The Company’s shareholder and investor interaction includes industry conferences, analyst meetings, investor road shows and individual meetings, both in person and virtually. The Company also provides information to stakeholders through its website, quarterly earnings calls, SEC filings, proxy statement, news releases, investor presentations and other communication channels. Shareholders and other interested parties may send communications to the Board or to specified individual directors. Any such communications should be directed to the attention of the Lead Independent Director at Apple Hospitality REIT, Inc., 814 East Main Street, Richmond, Virginia 23219. The Lead Independent Director will decide what action should be taken with respect to the communication, including whether such communication should be reported to the full Board. Share Ownership Guidelines. Guidelines. The Board believes that equity ownership by directors and executive officers will align their interests with shareholders’ interests. To that end, the Company has adopted formal share ownership guidelines, included in the Company’s Corporate Governance Guidelines, applicable to all of its directors and executive officers. On an annual basis, the Company evaluates the ownership status of the directors and executive officers. Directors and executive officers are required to own securities of the Company with a value equal to the following multiple of their annual base cash retainer (for directors) or their annual base salary (for executive officers): Directors | 2x4x

| Chief Executive Officer | 5x | Other executive officers | 3x |

New directors or executive officersand the Chief Executive Officer are required to comply with the ownership requirements within two years of becoming a member of the Board or Chief Executive Officer and other new executive officers are required to comply with the ownership requirements by January 1st of the year following the fourth anniversary of being named an executive officer. In February 2022, the Board increased the share ownership requirement applicable to directors from two times the annual base cash retainer to four times the annual base cash retainer with a transition period of two years. All current directors and executive officers currently comply withhave either met the equity ownership guidelines. levels of the guidelines or are within the applicable transition period. The Nominating and Corporate Governance Committee may waive the stock ownership requirements in the event of financial hardship or other good cause. Hedging and Pledging of Company Securities.The Company’sInsider Trading Policy prohibits directors and employees, including the executive officers, from hedging their ownership of the Company’s stock, including a prohibition on engaging in the following transactions: (i) trading in call or put options involving the Company’s securities and other derivative securities; (ii) engaging in short sales of the Company’s securities; (iii) holding the Company’s securities in a margin account; (iv) other hedging or monetization transactions related to the Company’s securities, including the use of financial instruments such as prepaid variable forwards, equity swaps, collars and (iv)exchange funds; and (v) pledging more than 50% of the number of the Company’s securities held individually to secure margin or other loans. Board Self-Evaluation.Pursuant to the Company’s Corporate Governance Guidelines and the charters of the Compensation, Audit and Nominating and Corporate Governance Committees of the Board of Directors, the Nominating and Corporate Governance Committee oversees the annual self-evaluation of the Board and each committee. The self-evaluation requires each director to complete a detailed questionnaire soliciting input on matters such as board structure and composition, committee structure, board and committee meeting conduct, board support, education, and board and committee performance. The Nominating and Corporate Governance Committee reports the assessments to the Board, and if the Board determines that changes in its governance practices need to be made, management and the Nominating and Corporate Governance Committee will work with the Board to implement the necessary changes. 17

ConsiderationTable of contents

Consideration of Director Nominees Director Qualifications. The Company believes the Board should encompass a diverse range of talent, skill and expertise sufficient to provide sound and prudent guidance with respect to the Company’s operations and interests. Each director also is expected to exhibit high standards of integrity, practical and mature business judgment, including the ability to make independent analytical inquiries, and be willing to devote sufficient time to carrying out their duties and responsibilities effectively. The Board has determined that the Board of Directors as a whole must have the right mix of characteristics and skills for the optimal functioning of the Board in its oversight of the Company. The Board believes it should be comprised of persons with skills in areas such as finance, real estate, investment, banking, strategic planning, human resources, leadership of business organizations, and legal matters. Although itthe Board does not have a diversity policy, the Board is committed to diversity and believes it is desirable for the Board to be composed of individuals who represent a mix of viewpoints, experiences and backgrounds. new director candidates is diverse and includes women, individuals from minority groups and underrepresented communities. In addition to the targeted skill areas, the Board looks for a strong record of achievement in key knowledge areas that it believes are critical for directors to add value to the Board, including: Strategy—knowledge of the Company’s business model, the formulation of corporate strategies, knowledge of key competitors and markets; | ●

| Strategy—knowledge of the Company’s business model, the formulation of corporate strategies, knowledge of key competitors and markets;

|

Leadership—skills in coaching and working with senior executives and the ability to assist the Chief Executive Officer; | ●

| Leadership—skills in coaching and working with senior executives and the ability to assist the Chief Executive Officer;

|

Organizational Issues—understanding of strategy implementation, change management processes, group effectiveness and organizational design; | ●

| Organizational Issues—understanding of strategy implementation, change management processes, group effectiveness and organizational design;

|

Relationships—understanding how to interact with investors, accountants, attorneys, management companies, analysts, and communities in which the Company operates; | ●

| Relationships—understanding how to interact with investors, accountants, attorneys, management companies, analysts, and communities in which the Company operates;

|

Functional—understanding of finance matters, financial statements and auditing procedures, technical expertise, legal issues, information technology and marketing; and | ●

| Functional—understanding of finance matters, financial statements and auditing procedures, technical expertise, legal issues, information technology and marketing; and

|

Ethics—the ability to identify and raise key ethical issues concerning the activities of the Company and senior management as they affect the business community and society. | ●

| Ethics—the ability to identify and raise key ethical issues concerning the activities of the Company and senior management as they affect the business community and society.

|

Nomination ProceduresProcedures.. The Board has established a Nominating and Corporate Governance Committee that oversees the nomination process and recommends nominees to the Board. As outlined above, in selecting a qualified nominee, the Board considers such factors as it deems appropriate, which may include the current composition of the Board; the range of talents of the nominee that would best complement those already represented on the Board; the extent to which the nominee would diversify the Board; the nominee’s standards of integrity, commitment and independence of thought and judgment; and the need for specialized expertise. Applying these criteria, the Board considers candidates for Board membership suggested by its members, as well as management and shareholders. Shareholders of record may nominate directors in accordance with the Company’s bylaws which require, among other items, notice sent to the Company’s Secretary not less than 60 days prior to a shareholder meeting that will include the election of Board members. No nominations other than those proposed by the Nominating and Corporate Governance Committee were received for the Annual Meeting. 18 Committees of the BoardBoard and Board Leadership Summary.Summary. The Board of Directors has four standing committees, which are specified below. The following table shows each committee’s function, membership and the number of meetings held during 2018:2021:

Committee | | Responsibilities | Responsibilities

| Members | Members

| | Number of Meetings During2018 2021 | Executive | | Has all powers vested in the Board of Directors, except powers specifically withheld under the Company’s bylaws or by law. | | Glade M. Knight*Knight(1) Glenn W. Bunting Jon A. Fosheim Justin G. Knight Bruce H. Matson

Daryl A. Nickel | | 0 | | | | | | | | Audit | | Responsibilities are outlined in its written charter that is available at the Company’s website, www.applehospitalityreit.com, and include oversight responsibility relating to the integrity of the Company’s consolidated financial statements and financial reporting processes. The audit committee also oversees the Company’s overall risk profile and risk management policies to include those related to cyber security. A report by the Audit Committee appears in a following section of this proxy statement. | | L. Hugh Redd*^Redd(1)(2) Glenn W. Bunting Jon A. Fosheim^ Blythe J. McGarvie^Fosheim(2)

| | 5 | | | | | | | | Compensation | | Responsibilities are outlined in its written charter that is available at the Company’s website, www.applehospitalityreit.com, and include administration of the Company’s compensation and incentive plans for the Company’s executive officers and oversight of the Company’s compensation practices. | | Glenn W. Bunting*Bunting(1) Daryl A. Nickel L. Hugh Redd | | 23

| | | | | | | | Nominating and Corporate Governance | | Responsibilities are outlined in its written charter that is available at the Company’s website, www.applehospitalityreit.com, and include oversight of all aspects of the Company’s corporate governance, director compensation, and nominations process for the Board of Directors and its committees. The Nominating and Corporate Governance Committee also reviews the Company’s policies, programs and practices related to corporate responsibility and sustainability, including environmental and related risks, social, human capital and other matters. | | Bruce H. Matson*Blythe J. McGarvie(1)

Jon A. Fosheim Blythe J. McGarvie

Daryl A. Nickel | Howard E. Woolley | 4

| 5 |

* Indicates Committee Chair

^ Indicates Audit Committee Financial Expert

Mrs. Kristian M. Gathright was appointed to the Board in March 2019 by the vote of the remaining directors.

(1) | Indicates the Committee Chair. |

(2) | Indicates Audit Committee Financial Expert. |

Board Leadership. The Board recognizes that one of its key responsibilities is to evaluate and determine its optimal leadership structure so as to provide independent oversight of management. The Board understands that there is no single generally accepted approach to providing Board leadership and the right Board leadership structure may vary as circumstances warrant. Consistent with this understanding, the independent directors periodically consider the Board’s leadership structure. Currently, the roles of Executive Chairman and Chief Executive Officer are held by different directors. Mr. Glade M. Knight serves as Executive Chairman and Mr. Justin G. Knight serves as President and Chief Executive Officer. The Board believes that this structure provides the appropriate balance between the authority of those who oversee the Company and those who manage it on a day-to-day basis. The Executive Chairman of the Board 19

Table of contents presides at all meetings of the shareholders and of the Board as a whole. The Executive Chairman performs such other duties, and exercises such powers, as from time to time shall be prescribed in the bylaws or by the Board. Additionally, the Board has appointed Mr. Jon A. Fosheim to serve as Lead Independent Director. The Lead Independent Director’s responsibilities include, among other things, presiding at meetings or executive sessions of the independent directors and non-employee directors, serving as a liaison to facilitate communications between the Executive Chairman, the President and Chief Executive Officer and other members of the Board, without inhibiting direct communications between and among such persons, and serving as a liaison to shareholders who request direct communications and consultations with the Board. Audit Committee Independence Independence. The Board of Directors has determined that each current member of the Audit Committee is “independent,”“independent” as defined in the listing standards of the NYSE. To be considered independent, a member of the Audit Committee must not (other than in his or her capacity as a director or committee member, and subject to certain other limited exceptions) either (a) accept directly or indirectly any consulting, advisory, or other compensatory fee from the Company or any subsidiary; or (b) be an affiliate of the Company or any subsidiary. The Audit Committee currently has threetwo members, Mr. Jon A. Fosheim Ms. Blythe J. McGarvie and Mr. L. Hugh Redd, who are “financial experts” within the meaning of the regulations issued by the Securities and Exchange Commission. The Company’s management believes that the combined experience and capabilities of the Audit Committee members are sufficient for the current and anticipated operations and needs of the Company.In this regard, the Board has determined that each Audit Committee member is “financially literate” and that at least threetwo members have “accounting or related financial management expertise,” as all such terms are defined by the rules of the NYSE. Board Meetings,, Attendance and Related Information. The Board held a total of fourthree meetings during 20182021 (including regularly scheduled and special meetings). It is the policy of the Company that directors should attend each annual meeting of shareholders. All directors at the time of the meeting attended the 20182021 Annual Meeting, except Ms. Blythe J. McGarvie. Ms. McGarvie had a previous commitment made prior to her appointment to the Board in February 2018 and was therefore unable to attend.Meeting. The Company also expects directors to attend each regularly scheduled and special meeting of the Board, but recognizes that, from time to time, other commitments may preclude full attendance. In 2018,2021, each director attended at least 75% of the aggregate of (a) the total number of meetings of the Board of Directors that were held during the period in which he or she was a director, and (b) the total number of meetings held by all committees of the Board on which he or she served during the period in which he or she served. Executive Sessions. The independent members of the Board of Directors meet independentindependently of management and the non-independent Directorsdirectors in executive sessions on a regular basis, presided by the Lead Independent Director. During 2021, the independent members of the Board of Directors met four times. 2018 2021 Compensation of Directors

The compensation of the directors is reviewed and approved annually by the Board of Directors. During 2018,2021, the directors of the Company were compensated as follows: Reimbursements to Directors in 2018.2021. All directors were reimbursed by the Company for travel and other out-of-pocket expenses incurred by them to attend meetings of the directors and committee meetings and in conducting the business of the Company. 17

TableCompensation of ContentsCompensation of IndependentNon-Employee Directors. With respect toIn 2021, the period prior to February 16, 2018, the independentnon-employee directors (classified by the Company as all directors other than Mr. Glade M. Knight and Mr. Justin G. Knight) received (i) a $140,000 annual retainer, with $60,000 paid in cash and $80,000 paid in vested stock grants, paidwere scheduled to receive the following compensation in quarterly installments, and (ii) a $1,000 fee for each meeting of the Board of Directors or any committee of the Board of Directors in excess of eight meetings per year for each of the Board or applicable committee (measured from June 1 through May 31 of the following year). Additionally, the Chair of the Audit Committee received an additional annual retainer fee of $7,000 (in addition to $1,000 per meeting for service on the Company’s Disclosure Committee) and the Chair of the Compensation Committee and the Nominating and Corporate Governance Committee each received an additional annual retainer fee of $5,000, each paid in quarterly installments.installments:

Position Held | 2021 Compensation | | Board of Directors - Annual Retainer (payable in cash) | $ | 65,000 | | Board of Directors - Annual Retainer (payable in common shares) | | 100,000 | | Audit Committee Chair (in addition to fees for service on Disclosure Committee) | | 15,000 | | Compensation Committee Chair | | 10,000 | | Nomination and Corporate Governance Committee Chair | | 10,000 | | Lead Independent Director | | 10,000 | |

In January 2018,2022, the Nominating and Corporate Governance Committee engaged FPL AssociatesFerguson Partners Consulting L.P. (“FPL”FPC”) to evaluate the independent directors’ compensation. Utilizing a similarthe same peer group as the report prepared for executive compensation discussed below under “Compensation Discussion and Analysis,” the independent directors’ 2017 compensationannual retainer paid to the non-employee directors, was indetermined to be on the 9th percentilelower end of the peer group’s 2016 compensation.group, ranking in the 25th percentile; 20

Table of contents separately it was found that the proportion of compensation paid in the form of equity was amongst the highest of the peer group, ranking in the top decile. After reviewing the report and considering FPL’sFPC’s recommendations, the Nominating and Corporate Governance Committee recommended to the Board of Directors a change to the independentnon-employee directors’ compensation to bring the compensation close to the median of the peer group. The Nominating and Corporate Governance Committee believes the change was important to continue to attract and retain superior board members. Upon review and discussion of the Nominating and Corporate Governance Committee’s recommendation, the Board of Directors approved the following independentnon-employee director compensation effective February 16, 2018:beginning March 2022: (i) an annual retainer, calculated from March of $165,000the current year through February of the following year, of $185,000 ($100,000115,000 paid in vested stock grants and $65,000$70,000 paid in cash) paid in quarterly installments, (ii) an annual retainer for the Chair of the Audit Committee of $15,000$20,000 (in addition to fees for service on the Company’s Disclosure Committee) paid in cash in quarterly installments, and (iii) an annual retainer for the Chair of the Compensation Committee, the Chair of the Nominating and Corporate Governance Committee and the Lead Independent Director of $10,000$15,000, each paid in cash in quarterly installments. There will no longer be fees paid for meetings of the Board of Directors or any committee of the Board of Directors in excess of eight meetings per year. Non-Employee Director Deferral Program.Deferral Program. In 2018, effective Effective June 1, 2018, the Board of Directors adopted the Non-Employee Director Deferral Program (the “Director Deferral Program”) under the Apple Hospitality REIT, Inc. 2014 Omnibus Incentive Plan (the “2014 Omnibus Incentive Plan”) for the purpose of providing non-employee members of the Board the opportunity to elect to defer receipt of all or a portion of the annual retainer payable to them for their service on the Board, including the portion of the annual retainer amounts payable in cash (including for service as a Chair of a committee of the Board or Lead Independent Director) and the portion of the annual retainer amounts payable in fully vested Common shares.Shares. As specified by the director, the receipt of payment may be deferred until either (i) the date that his or her service on the Board has ended, (ii) a specified date, or (iii) the earlier of the specified date or the date that his or her service on the Board has ended. The deferred amounts will also be paid if, prior to the time specified by the director, the Company experiences a change in control or upon death of the director. For the portion of the director fees payable in shares, the director may elect to defer his or her fees in the form of deferred stock units, and for the portion of the director fees payable in cash, the director may elect to defer his or her fees either in the form of deferred stock units or as deferred cash fees. Under the Director Deferral Program, the Company has established a notional deferral account (for bookkeeping purposes only) for each non-employee director who has elected to participate and all deferred fees are credited to this account, whether in cash or stock, as of the date the fee otherwise would have been paid to the director (the “Quarterly Deferral Date”). Deferred fees converted into deferred stock units are credited to the deferral account based on the fair market value of the Company’s common sharesCommon Shares on the Quarterly Deferral Date. On each Quarterly Deferral Date, dividends earned on deferred stock units are credited to the deferral account in the form of additional deferred stock units based on dividends declared by the Company on its outstanding common shares Common Shares during the quarter and the fair market value of the stock on such date. Additionally, on each Quarterly Deferral Date, deferred cash fees are credited with an additional deferred cash amount based on the dividends declared by the Company during the quarter on its outstanding common sharesCommon Shares and the share equivalent, as defined in the Director Deferral Program, of the deferred cash balance from the preceding quarter. Upon the applicable payment date, as described above in the preceding paragraph, any deferred stock units credited to a director’s deferral account will be settled solely by delivering an amount of the Company’s Common Shares equal to the number of such deferred stock units, and, with respect to any deferred cash fees credited to the director’s deferral account, such fees will be paid solely in the form of cash. Directors have no rights as shareholders of the Company with respect to deferred stock units credited to their deferral accounts. During 2018, four2021, three of the non-employee directors elected to participate in the Director Deferral Program by deferring all or a portion of their annual retainer fees in the form of deferred stock units.units and/or deferred cash fees. Non-IndependentEmployee Directors. Mr. Glade M. Knight and Mr. Justin G. Knight and Mrs. Kristian M. Gathright are non-independentemployee directors of the Company and receiveaccordingly, during 2021, they received no compensation from the Company during their term of employment for their services as directors.

21

Table of contents Director Compensation.Compensation. The following table shows the amounts earned in 20182021 by the Company’s non-employee directors. Director | | Fees Earned or Paid in Cash (1) | | | Share Awards (2) | | | All Other Compensation (3) | | | Total | | Glenn W. Bunting | | $ | 73,722 | | | $ | 95,704 | | | $ | - | | | $ | 169,426 | | Jon A. Fosheim | | | 73,083 | | | | 95,704 | | | | 746 | | | | 169,533 | | Kristian M. Gathright (4) | | | - | | | | - | | | | - | | | | - | | Glade M. Knight | | | - | | | | - | | | | - | | | | - | | Justin G. Knight | | | - | | | | - | | | | - | | | | - | | Bruce H. Matson | | | 73,722 | | | | 95,704 | | | | 746 | | | | 170,172 | | Blythe J. McGarvie (5) | | | 55,791 | | | | 77,202 | | | | - | | | | 132,993 | | Daryl A. Nickel | | | 64,361 | | | | 95,704 | | | | 698 | | | | 160,763 | | L. Hugh Redd | | | 82,339 | | | | 95,704 | | | | 428 | | | | 178,471 | |

Director | | Fees Earned or Paid in Cash (1) | | Share Awards (2) | | All Other Compensation (3) | | Total | | Glenn W. Bunting | | | $ | 75,000 | | | | | $ | 98,266 | | | | | $ | - | | | | | $ | 173,266 | | Jon A. Fosheim | | | | 75,000 | | | | | | 98,266 | | | | | | 901 | | | | | | 174,167 | | Kristian M. Gathright | | | | 65,000 | | | | | | 98,266 | | | | | | - | | | | | | 163,266 | | Blythe J. McGarvie | | | | 75,000 | | | | | | 99,976 | | | | | | - | | | | | | 174,976 | | Daryl A. Nickel | | | | 65,000 | | | | | | 98,266 | | | | | | 973 | | | | | | 164,239 | | L. Hugh Redd | | | | 84,000 | | | | | | 98,266 | | | | | | 578 | | | | | | 182,844 | | Howard E. Woolley (4) | | | | 54,347 | | | | | | 74,982 | | | | | | 90 | | | | | | 129,419 | |

(1) | TheIn addition to cash fees not deferred, the amounts in this column include any cash fees that non-employee directors elected to defer in the form of deferred stock units or deferred cash fees under the Director Deferral Program.

|

(2) | The amounts in this column reflect the grant date fair value determined in accordance with FASB ASC Topic 718. Each director thatMs. McGarvie was awarded 6,684, Mr. Bunting, Mr. Fosheim, Mrs. Gathright, Mr. Nickel and Mr. Redd were awarded 6,564 and Mr. Woolley, who became a member of the Board of Directors for the full year of 2018, except Mr. Glade M. Knight and Mr. Justin G. Knight,on March 1, 2021, was awarded 5,5244,930 fully vested Common Shares (or deferred stock units if so elected). Ms. Blythe J. McGarvie, who was appointed to the Board in February 2018, was awarded 4,435 fully vested Common Shares. The amounts in this column include share awards that non-employee directors elected to defer in the form of deferred stock units under the Director Deferral Program. No share options were granted in 2018.2021. |

(3) | This column represents earnings on deferred stock unit and deferred cash fee accounts under the Director Deferral Program. |

(4) | Mrs. Kristian M. Gathright was notHoward E. Woolley became a member of the Board in 2018 and will not receive compensation for her services as director until her planned retirement from her role as Executive Vice President and Chief Operating Officer of the Company in 2020.

| (5)

| Ms. Blythe J. McGarvie was appointed to the Board in February 2018 and, as a result, received cash fees and share awards prorated for her time of service.Directors on March 1, 2021.

|

Outstanding Stock Option Awards. Option Awards. In 2008, the Company adopted the Apple REIT Nine, Inc. 2008 Non-Employee Directors Stock Option Plan (the “Directors’ Plan”). The Directors’ Plan provided for automatic grants of options to acquire Common Shares. The Directors’ Plan applied to directors of the Company who were not employees or executive officers of the Company. In May 2015, theThe Directors’ Plan was terminated effective upon the listing of the Company’s Common Shares on the NYSE on May 18, 2015 (the “Listing”). No further grants can be made under the Directors’ Plan, provided however, the termination did not affect any outstanding director option awards previously issued under the Directors’ Plan. Following the termination of the Directors’ Plan, all awards to directors are made under the 2014 Omnibus Incentive Plan. Since adoption of the Directors’ Plan, none of the current directors have exercised any of their options to acquire Common Shares. See “Ownership of Certain Beneficial Owners and Management” for the number of outstanding options that were granted to certain directorsMr. Glenn W. Bunting under the Directors’ Plan, which are all fully vested, as of the Record Date. There were noSince adoption of the Directors’ Plan, Mr. Bunting has not exercised any of his options to acquire Common Shares. The directors did not have any other outstanding option awards granted to directors as of the Record Date.

Audit Committee Report The Audit Committee of the Board of Directors is currently composed of fourthree directors. All fourthree directors are independent directors as defined under “Committees of the Board and Board Leadership—Audit Committee Independence.” The Audit Committee operates under a written charter that was adopted by the Board of Directors and is annually reassessed and updated, as needed, in accordance with applicable rules of the Securities and Exchange Commission. The Audit Committee oversees the Company’s financial reporting process on behalf of the Board of Directors. In fulfilling its oversight duties, the Audit Committee reviewed and discussed the audited financial statements for fiscal year 20182021 with management and the Company’s independent auditors, Ernst & Young LLP, including the quality and acceptability of the accounting principles, the reasonableness of significant judgments, any critical audit matters identified during the audit and the clarity of disclosure in the financial statements. The Audit Committee also reviewed management’s report on its assessment of the effectiveness of the Company’s internal control over financial reporting and Ernst & Young LLP’s report on the effectiveness of the Company’s internal control over financial reporting. Management is responsible for the preparation, presentation and integrity of the Company’s financial statements, accounting and financial reporting principles, internal controls, and procedures designed to assure compliance with accounting standards and applicable laws and regulations. Ernst & Young LLP is responsible for performing an independent audit of the consolidated financial statements and the notes thereto in accordance with generally accepted auditing standards. 22

Table of contents The Audit Committee also has discussed with the independent auditors the matters required to be discussed pursuant to the applicable requirements of the PCAOB Auditing Standard No. 1301, “Communication with Audit Committees.”and the Securities and Exchange Commission. Additionally, the Audit Committee has received the written disclosures and letter from the independent auditors required by the applicable requirements of the PCAOB Ethics and Independence Rule 3526, “Communicationsregarding the independent auditor’s communications with the Audit Committees Concerning Independence,”Committee concerning independence and has discussed, with the independent auditors, the independent auditors’ independence. Based on the review and discussions described in this Report, the Audit Committee recommended to the Board of Directors that the audited financial statements be included in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 20182021 for filing with the Securities and Exchange Commission. | Current Members of the Audit Committee: | | L. Hugh Redd, Chair | | Glenn W. Bunting | | Jon A. Fosheim Blythe J. McGarvie

|